Call us: 0731-402-8443, 750-900-8989 | Email: infinityservices2018@gmail.com

Call us: 0731-402-8443, 750-900-8989 | Email: infinityservices2018@gmail.com

Opting for the new income tax regime in India requires comprehending the fundamental differences between the old and new regimes and evaluating which one aligns more favourably with your financial situation. Presented below is an in-depth manual to assist you in making an accurate decision: Understanding both the Old and New Regimes Old Regime A […]

Read More

Prior to submitting your income tax return (ITR), it is necessary to submit Form 10IE if you wish to choose the new tax system. The new tax system, which was introduced in the Union Budget 2020, offers reduced tax rates. However, it does not allow for most of the deductions and tax benefits that were […]

Read More

The National Pension System (NPS) is a voluntary, extended-term retirement investment programme in India. The Government of India introduced the programme in 2004, with a primary focus on persons in the unorganised sector and those who are self-employed. The following are essential aspects of the National Pension Scheme: Objective: The main goal of NPS is […]

Read More

Section 194O of the Income-tax Act, 1961 deals with Tax Deducted at Source (TDS) on payments made to e-commerce participants. It was introduced in the Union Budget 2020 and came into effect on 1st October 2020. Here’s a summary of the key points of Section 194O: Who is responsible for deducting TDS? E-commerce operators like […]

Read More

Login to incometax.gov.in Go to “Services” and click on “Challan Correction”. Click on “Create challan correction request”. Select the attributes which needs to be corrected. For example: Assessment year, major head, minor head Select the “Assessment year” or “Challan Identification Number” (CIN) All the open challans will be displayed on the next screen. You need to […]

Read More

A Goods and Services Tax (GST) audit is a comprehensive review of a taxpayer’s financial records, returns, and compliance with the provisions of the Central Goods and Services Tax Act, 2017 (CGST Act) and its corresponding state GST acts. The primary objective of a GST audit is to ensure that taxpayers are accurately reporting their […]

Read More

The Digital India Act (DIA) The Digital India Act (DIA) is a proposed piece of legislation that intends to act as a catalyst for the Indian economy by encouraging more innovation and entrepreneurs while also safeguarding Indian residents in terms of safety, trust, and accountability. The DIA is predicted to have a large direct and […]

Read More

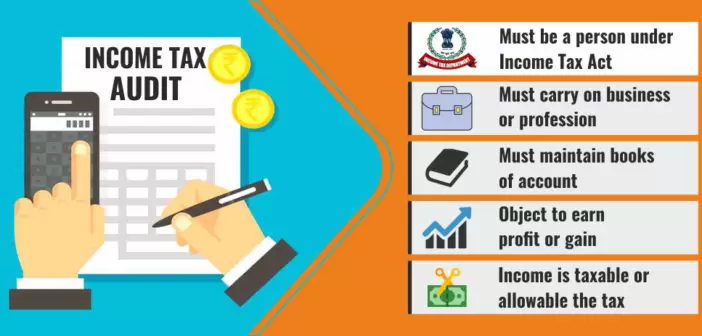

In India, an income tax audit is conducted under Section 44AB of the Income Tax Act, 1961. It is a formal examination of a taxpayer’s financial records and tax return by a chartered accountant (CA) or a tax auditor to ensure compliance with the provisions of the Income Tax Act. Income tax audits in India […]

Read More

Filing income tax returns offers several benefits for individuals and the broader economy. Some of the key advantages include: 1. Compliance with the Law Paying income tax and filing returns is a legal obligation in many countries. By fulfilling this responsibility, individuals comply with the tax laws, helping maintain a fair and functioning tax […]

Read More

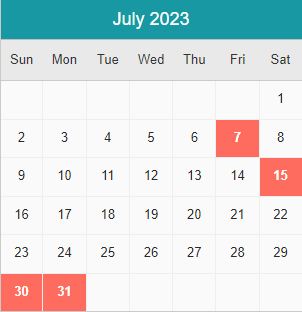

7 July 2023 – Due date for deposit of Tax deducted/collected for the month of June, 2023. However, all sum deducted/collected by an office of the government shall be paid to the credit of the Central Government on the same day where tax is paid without production of an Income-tax Challan 7 July 2023 – […]

Read More