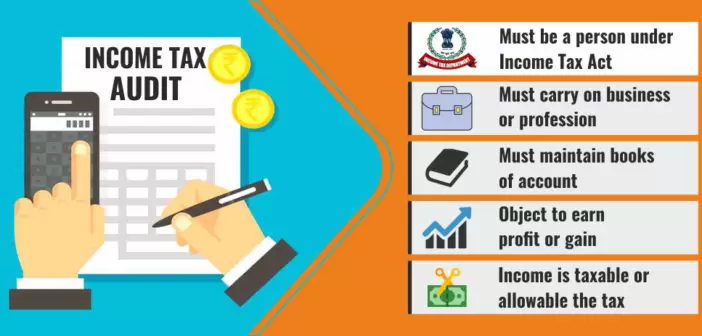

In India, an income tax audit is conducted under Section 44AB of the Income Tax Act, 1961. It is a formal examination of a taxpayer’s financial records and tax return by a chartered accountant (CA) or a tax auditor to ensure compliance with the provisions of the Income Tax Act. Income tax audits in India are applicable to certain categories of taxpayers meeting specific criteria.

Key Points about Income Tax Audit in India:

1. Mandatory Audit Threshold

As per Section 44AB, the following categories of taxpayers are required to undergo a tax audit if their total income in a financial year exceeds the specified threshold:

a. Businesses: Any person carrying on a business with total sales, turnover, or gross receipts exceeding Rs 1 crore in a financial year (Rs 2 crore from FY 2020-21 onwards).

b. Professionals: Any professional (e.g., doctors, lawyers, architects) with gross receipts exceeding Rs 50 lakhs in a financial year.

c. Presumptive Taxation Scheme: Taxpayers opting for the Presumptive Taxation Scheme under Sections 44AD, 44ADA, or 44AE, and having income lower than the deemed profits and gains.

2. Appointment of Tax Auditor

The taxpayer subject to tax audit needs to appoint a qualified chartered accountant as a tax auditor. The tax auditor will conduct the audit and provide an audit report in the prescribed format (Form 3CA/3CB and Form 3CD).

- Audit Process: During the tax audit, the tax auditor examines the taxpayer’s books of accounts, financial statements, supporting documents, and other relevant records to ensure the accuracy and compliance of the tax return.

- Due Date for Filing Audit Report: The audit report along with the income tax return must be filed by the due date for filing income tax returns, which is usually September 30th of the assessment year (i.e., the year following the financial year).

- Consequences of Non-Compliance: Failure to comply with the tax audit requirements can lead to penalties under Section 271B. A penalty of 0.5% of the total sales, turnover, or gross receipts, subject to a maximum of Rs 1,50,000, can be imposed.

It’s important for taxpayers meeting the audit criteria to ensure timely compliance with the tax audit requirements to avoid penalties and other consequences. Consulting with a qualified chartered accountant or tax consultant can help in the smooth conduct of the tax audit and proper filing of the audit report.